How to Use MACD in Amibroker for Making Profit

MACD is a leading indicator and oscillator that’s used for measuring the difference between two moving averages. As the new candle closes, it creates and calculates values of a 21-day exponential moving average (EMA), which is subtracted from and plotted alongside a 3-day EMA. Macd provides us with signals in form of Arofit, Byefit, Crossovers as well as Divergences.

What is MACD?

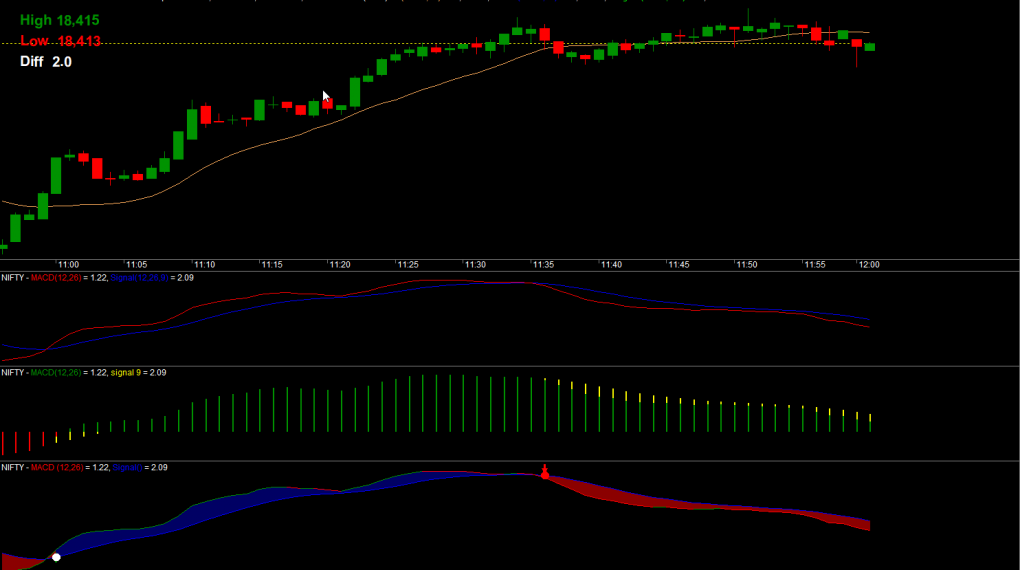

MACD is a technical indicator that is used to measure momentum. It is created by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA. MACD is displayed as a histogram and oscillates above and below the zero line. A signal line is created by calculating the nine-day EMA of MACD. MACD generates buy and sell signals by looking for divergences between MACD and the signal line. A bullish divergence occurs when MACD starts to make higher lows while the signal line makes lower lows. This indicates that momentum is starting to increase to the upside. A bearish divergence occurs when MACD starts to make lower highs while the signal line makes higher highs. This indicates that momentum is starting to decrease to the downside.

Tools Needed: Tick data, Amibroker and a Graphical Programming tool

When it comes to trading, one of the most important things you can do is to have the right tools at your disposal. This is especially true when you are using technical analysis to make decisions. One of the most popular technical indicators is MACD, and in this article we will show you how to use MACD in Amibroker to make profits. First things first, you need to make sure you have tick data for your Amibroker software. This is important because you need accurate data in order to make accurate decisions. Once you have this data, you can begin creating your MACD indicator. There are two ways to create a MACD indicator in Amibroker. The first way is to use the built-in MACD function. To do this, simply go to the “Indicators” drop-down menu and select “MACD”. The second way is to use a graphical programming tool like AFLcode.com. We prefer this method because it allows us to customize the indicator to our own preferences. Whichever method you choose, once you have your MACD indicator created, you need to know how to interpret it. Essentially, the MACD line shows the difference between

Setting up the Graphical Programming Tool

MACD, or Moving Average Convergence Divergence, is a technical analysis tool that can be used to measure the momentum of a stock. MACD is calculated by subtracting the 26-day moving average from the 12-day moving average. A 9-day moving average, called the signal line, is then plotted on top of the MACD line. MACD signals include crossovers, divergences, and rapid movements in the MACD line. Crossovers happen when the MACD line crosses above or below the signal line. A bearish crossover happens when the MACD line crosses below the signal line and is generally considered a sell signal. A bullish crossover happens when the MACD line crosses above the signal line and is generally considered a buy signal. Divergences happen when the direction of the MACD line diverges from the direction of the price action. A bullish divergence happens when the MACD line starts to make higher lows while prices are making lower lows. This suggests that momentum is starting to turn in favor of an upward move. A bearish divergence happens when the MACD line starts to make lower highs while prices are making higher highs. This suggests that momentum is starting to turn

Entering Data into the Graphical Programming Tool Chart

In order to use MACD in Amibroker, you must first enter the data into the graphical programming tool chart. This can be done by downloading data from your broker, or by manually entering it in. To download data from your broker, simply click on the “Data” tab and select “From Broker”. Then, choose your broker and select the account you want to download data from. Once you have done this, select the timeframe you want to download data for and click “OK”. If you want to manually enter data into the chart, simply click on the “Data” tab and select “Add/Edit Data”. Then, enter the date, open, high, low, close, and volume for each bar. When you are finished, click “OK”. Now that you have your data entered into the chart, you can begin using MACD. To do this, simply click on the “Indicators” tab and select “MACD”. Then, enter the parameters you want to use and click “OK”. You should now see the MACD indicator on your chart. You can use this indicator to help make trading decisions. For example, if the MACD line crosses above the

The Gain Difference Method

The MACD is one of the most popular technical indicators used by traders. The MACD stands for Moving Average Convergence Divergence and is used to identify trend changes in the market. The MACD is a lagging indicator, which means it will follow the price action of the security. The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA. The difference between these two moving averages is plotted as a histogram or line on a chart. This line is called the MACD line. The MACD has two additional lines called the signal line and the trigger line. The signal line is a 9-day EMA of the MACD line. The trigger line is a 26-day EMA of the MACD line. Traders use the MACD to generate buy and sell signals. A buy signal occurs when the MACD line crosses above the signal line. A sell signal occurs when the MACD line crosses below the signal line. The MACD can also be used to identify overbought and oversold conditions in the market. An overbought market occurs when the MACD line is above

The Directional Movements of MACD Sensitivity Lines + Time Span

The moving average convergence divergence (MACD) is a tool that technical analysts use to measure momentum. The MACD indicator is calculated by subtracting the 26-period exponential moving average (EMA) from the 12-period EMA. A 9-day EMA of the MACD, called the “signal line”, is then plotted on top of the MACD line, which can function as a trigger for buy and sell signals. The MACD indicator is used to find new trends and to signal the end of a current trend. The MACD indicator can be used for day trading and swing trading, but it can also be used on longer time frames such as 4-hour and daily charts. The amount of time that you use for your moving averages will depend on your trading timeframe. For day trading, you will want to use shorter timeframes such as the 5-minute, 15-minute, or 30-minute chart. For swing trading, you can use timeframes such as the 4-hour or daily chart. The MACD indicator is most effective in volatile markets. In a strong uptrend or downtrend, the MACD will frequently generate false signals. Therefore, it’s important to

Rules and Conditions for using MACD

When it comes to technical analysis, one of the most popular indicators is the Moving Average Convergence Divergence (MACD). MACD is a trend following indicator that can be used to identify both the direction and momentum of a market. It is also a popular tool among traders for making profit. However, there are certain rules and conditions that must be followed when using MACD in Amibroker. These are as follows:

1) MACD should only be used on timeframes of H4 or above. This is because MACD is a long-term indicator and therefore using it on smaller timeframes will not produce accurate results.

2) The default settings for MACD are 12,26,9. However, these settings can be changed according to the trader’s preference.

3) MACD consists of two moving averages (the fast line and the slow line) as well as a histogram. The two moving averages are used to calculate the momentum of the market, while the histogram is used to measure the distance between the two moving averages. 4) When using MACD in Amibroker, traders should look for divergences between the MACD line and price

Risks and Dangers of using MACD

When it comes to technical analysis, one indicator that is widely used by traders is the MACD or Moving Average Convergence Divergence indicator. MACD is a trend following momentum indicator that shows the relationship between two moving averages of prices. It is generally used to identify new trends and gauge the strength of the current trend. While MACD can be a useful tool for identifying trading opportunities, there are also risks and dangers associated with using this indicator. One of the main dangers of using MACD is that it is a lagging indicator, which means that it will only provide signals after the trend has already started. This means that there is a risk of entering into a trade too late and missing out on potential profits. Another risk associated with MACD is that it is prone to false signals. This means that there is a danger of incorrectly identifying a trading opportunity and making an incorrect trade. To minimise the risks associated with using MACD, it is important to understand how the indicator works and use it in conjunction with other technical indicators or forms of analysis. It is also important to practice using MACD on a demo account before using it on a live account. By doing this, you can gain experience in using MACD

Important Notes about MACD

MACD is one of the most popular technical indicators used by traders. MACD stands for Moving Average Convergence Divergence and is used to gauge the strength of a trend. The MACD indicator is comprised of two moving averages which help to identify changes in momentum. The MACD indicator can be used on any time frame but is most commonly used on hourly, daily, or weekly charts. The MACD indicator is a lagging indicator which means it will follow price. This means that the MACD indicator will lag behind price when there is a change in direction. The MACD indicator can be used to identify trends as well as possible reversals. The MACD indicator is also used to generate buy and sell signals. When the MACD line crosses above the signal line, it is a buy signal. When the MACD line crosses below the signal line, it is a sell signal. It is important to note that these signals are not always accurate and should be used in conjunction with other technical indicators and analysis. The MACD indicator can be a valuable tool for traders who use it correctly. It is important to remember that the MACD indicator is a lagging indicator and should be used in conjunction with other.

You can get best auto buy sell indicator for amibroker free with Yearly package of EqualRT Data Feed